Improve Efficiency and Reduce Costs

At-scale trade surveillance across all lines of defense

-1.png?width=500&height=416&name=img%20(1)-1.png)

At Eventus, we believe that continuous innovation is the key to dealing with rapid and complex market changes.

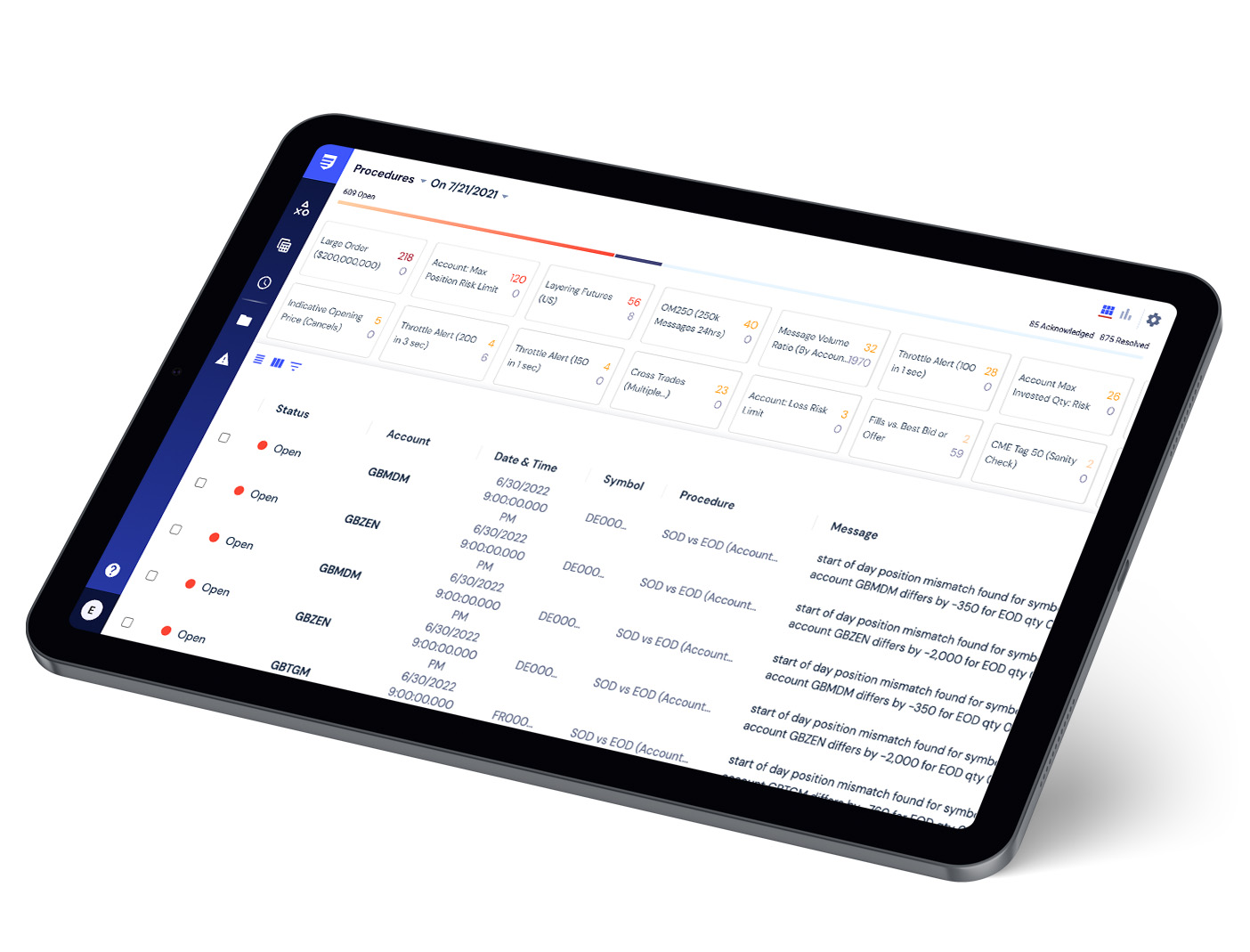

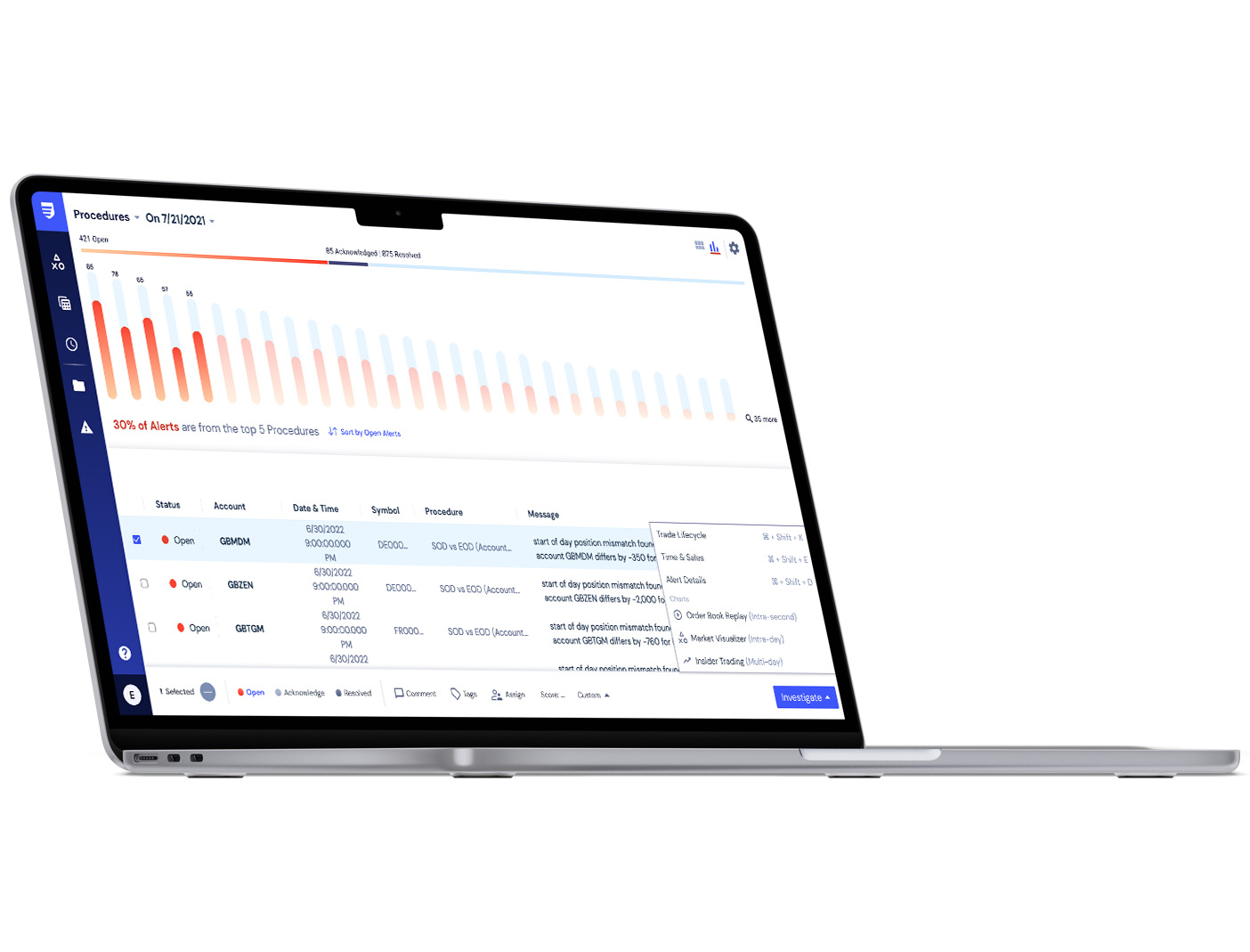

- Intuitive data visualizations for faster insights

- New integrations for supporting case management

- Advanced filtering techniques for comprehensive surveillance

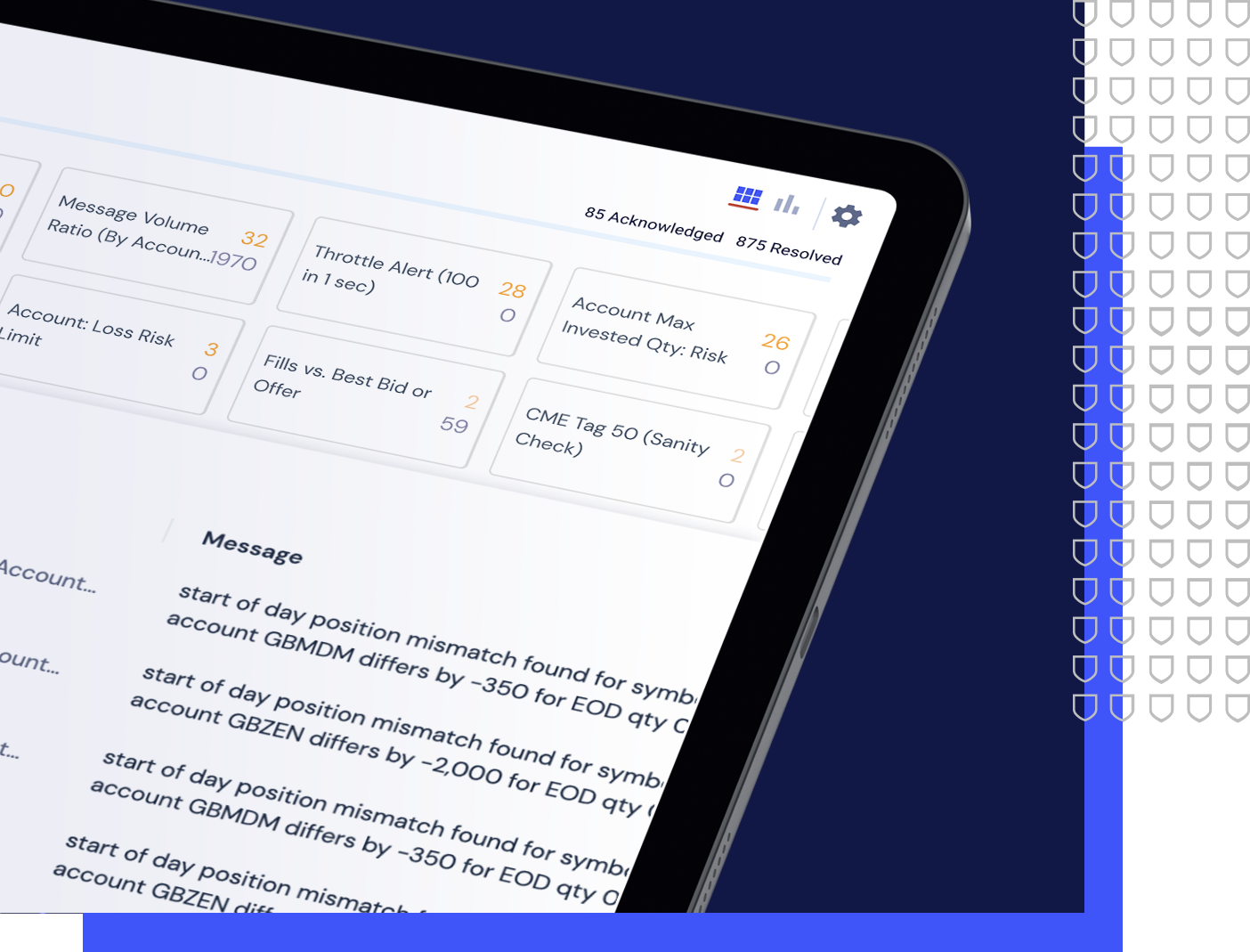

Take control of your surveillance program and easily access all your procedures and reports running in a centralized and streamlined cockpit for managing alert activity.

Resolve up to 85% of your alerts with automations

Get a free demo of our Validus platform

Awards and Accolades

Best-in-class Technology and Exceptional Service

/WTGWTAA25-Eventus-Surveillance%20(1).png)

/EVN%20FOW%202023%20Award.jpg)

Responsive

Drive efficiency in your trade surveillance program

- We have built over 60 automations which has resulted in explainable and automated resolution of up to 85% of candidate alerts

- Robotic Process Automation (RPA), machine learning (ML), and procedural automation drive anomaly detection and pattern matching to escalate the most actionable alerts

- Infinite automation configuration enable Validus users to remove the mundane tasks of closing near miss and false positive alerts

- High-touch, collaborative service model focuses on success for our clients

At-scale

Swiftly escalate actionable alerts and protect your firm from risk

- Massively scalable technology battle-tested in large, high-volume trading firms in the most complex environments

- Our platform handles burst rates that surpass 150,000 messages per second in near real-time and ensures scalable processing of ever-growing client volumes

- Data-agnostic platform removes heavy data ingestion burdens from users

- Rapid and simple onboarding of any client data source and coverage of over 100+ market centers and 70+ integration points

Innovation

Continuous refinement and development

- Reduce the total cost of ownership and the burden of data ingestion with intuitive technology

- Automation and advanced data ingestion enable compliance teams to quickly and accurately filter through false positives

- Our easy-to-configure and personalized procedures drive efficiency and empower our clients by delivering targeted, actionable results with a high degree of precision

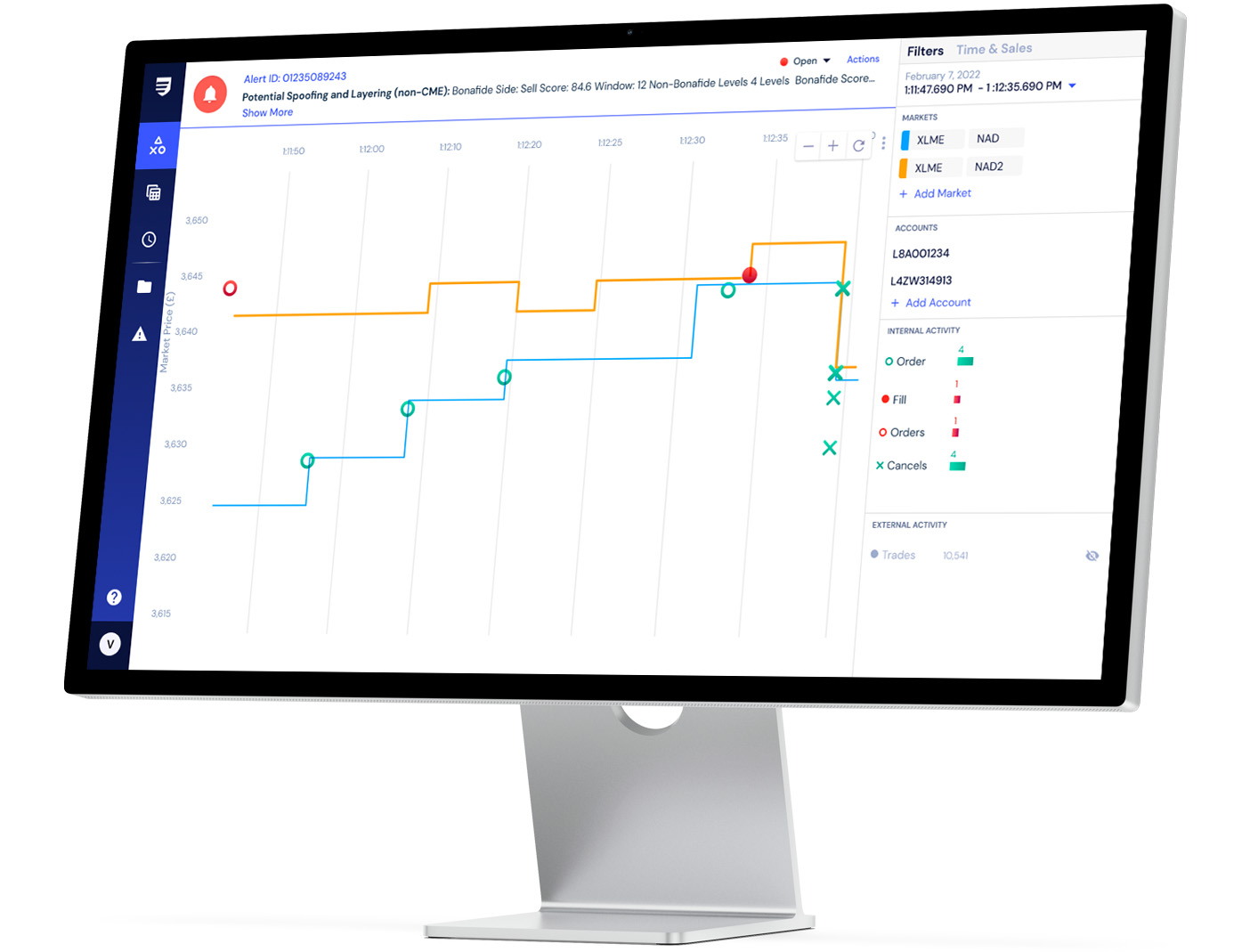

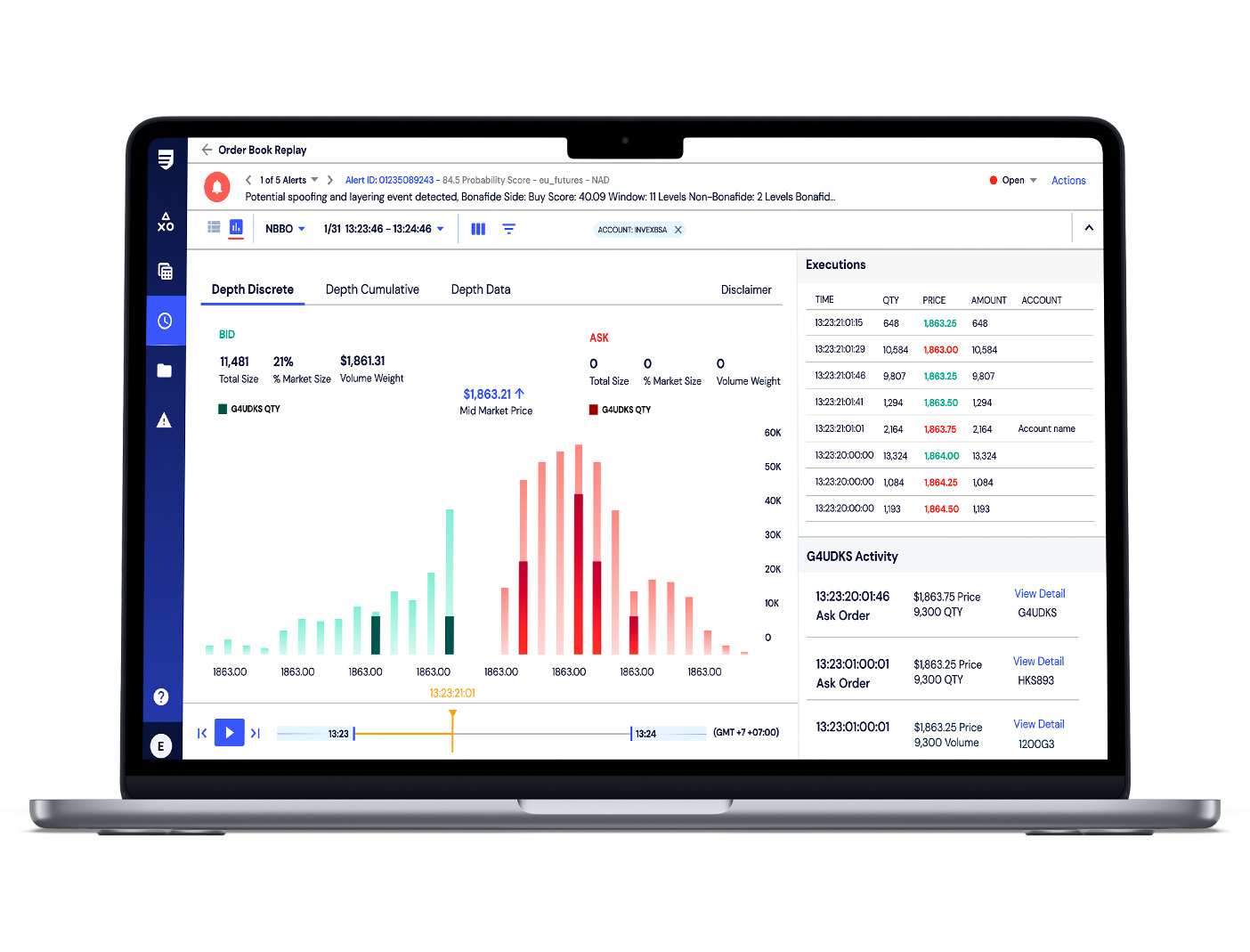

- The Validus platform is built to seamlessly support client-specific reporting, investigative tools, and visualizations

Expertise

Unparalleled knowledge in regulatory compliance

- Founded by a former Chief Compliance Officer and a team of seasoned post-trade operations technologists

- Gain access to a team of regulatory and surveillance experts to understand and navigate shifting regulatory requirements

- Focused on alignment across all lines of defense, Validus provides coverage across key areas of regulatory, operational, financial and technology risk in one platform

- Over 40% of the Eventus team are capital market veterans that bring experience from global markets

Tailored Trade Surveillance

Designed for your firm's regulatory and compliance needs

Our Clients

Trusted by the world’s most sophisticated firms

Validus Core Solutions

Innovating the future-state of surveillance

Automations

Leverage machine learning and robotic process

automation to escalate the most actionable alerts

Data Ingestion

Rapid and simple onboarding of any data source. Coverage of over 100+ market centers and 70+ integration points

Powerful Tools

The Validus platform is built to easily support client-specific reporting, investigative tools, and custom visualizations

Designed by Practitioners, Shaped by Clients

We actively listened to our clients' challenges, pain points, and needs, and incorporated their valuable input into our new UI. As a result, this release has been truly shaped by our clients

Validus Platform Features

Extremely Powerful, Easy to Deploy

Save time and resources while mitigating the risk of fines and reputational damage

Real-Time Environment

Prioritization of Important Actionable Alerts

Alerting to Remediation

Targeted Compliance

Account Data Integration

Data Reconciliation

100+ Market Centres

Combat Ever-evolving Risk

State-of-the-art Trade Surveillance Software

Learn how compliance leaders are driving operational efficiencies with Validus

Download the Validus product sheet for an overview of the highlighted features and core functionality including:

- Comprehensive coverage across trade surveillance, algo monitoring, and risk controls in a single platform

- Greater visibility into the most critical and actionable alerts

- Increased surveillance efficiency through streamlined processes and real-time insights

- Responsive and customized solutions that allow users to manage procedures and parameters tailored to your firm

- Intuitive technology, automation, and advanced analytics

.png?width=1545&height=2000&name=Product%20Sheet%20Thumbnail%20(2023).png)

Client Testimonial

-SENIOR DIRECTOR AND CHIEF COMPLIANCE OFFICER, R.J. O’BRIEN

GET A DEMOFAQs

Why is trade surveillance important?

The Securities and Exchange Commission (SEC), FINRA, CFTC, NFA, and national exchanges have rules about the prohibition of fraud and manipulation, order and trade handling, market access controls, broker-dealer licensing requirements, supervisory control systems, Manning, and limit order display.

For any of these areas, inadequate or poorly calibrated trade surveillance systems can lead to regulatory inquiries and fines. Regulators also will issue enforcement actions for insufficient review of surveillance output, poor training, and a lack of documentation.

Trade surveillance also helps broker-dealers detect and deter market abuse that could lead to expensive civil and criminal liability. The SEC alone is issuing record fines and using a whistleblower program. Under U.S. law, some manipulative trading, like spoofing, can be a criminal offense with prison time.

What types of manipulative trading does Validus monitor?

Validus Trade Surveillance has a full suite of alerts and procedures for broker-dealers. This includes financial and controls for orders and quoting, regulatory controls for intermarket sweep orders (ISOs), market manipulation, Regulation SHO order marking and shortability, and supervisory reports.

Please contact us to learn more.

Here are a few of the market manipulation types that have a Validus alert:

Spoofing is a form of market manipulation in which a trader submits a bid or offer in a security or commodity on an exchange or other trading platform with the intent to cancel the bid or offer before it can be executed.

Layering is like spoofing but with multiple submitted bids or offers at different levels of the order book on an exchange or other trading platform with the intent to cancel the bids or offers before they can be executed.

Both spoofing and layering give a misleading view of supply or demand to artificially move the price to benefit the opposite side execution.

Flashing is the practice of submitting and quickly canceling an order, typically of large size, intended to send a misleading signal to the market.

Front running is when proprietary trading accounts or employee accounts send orders in the moments before customer orders in the same instruments.

Insider trading is when a person trades based on material non-public information to reap a profit or avoid a loss.

Momentum ignition is a series of orders that contributed to a spike in the short-term price of security. Ultimately, the trader seeks profits from this artificial increase in price and will exit out of the larger position at a better price.

Wash trading is when a firm, account, or client appears to be on the same side of a trade with no change of beneficial ownership. Similarly, a wash cross trade is when two or more accounts appear to be on either side of multiple trades resulting in no change of beneficial ownership.

How does Validus handle changing regulatory requirements?

Eventus conducts ongoing research about global financial regulations and engages directly with regulators and market participants. We then feed that research into Validus and work directly with our clients to ensure our software is tailored to their changing needs.

In the U.S., some specific regulatory requirements include:

- Section 10(b) of the Securities Exchange Act of 1934 and associated Rule 10b-5 that cover the prohibition of fraud and manipulation.

- Regulation NMS governs order and trade handling requirements for fair and orderly markets and with “best execution” rules. Rule 611 offers an exemption for inter-market sweep orders (ISOs) under certain circumstances.

- Regulation SHO/order marking and locates are rules governing short sales.

- Rule 15c3-5 covers market access controls.

- Reg ATS are the rules for alternative trading systems.

- FINRA Rule 3110 are the general supervision rules.

- FINRA Rule 3120 covers supervisory control systems and annual testing

Take Control of your Surveillance Program